are corporate campaign contributions tax deductible

Depending on the circumstances Dark Money can refer to funds spent by a political nonprofit or a super PAC. There are many benefits to obtaining 501c3 status.

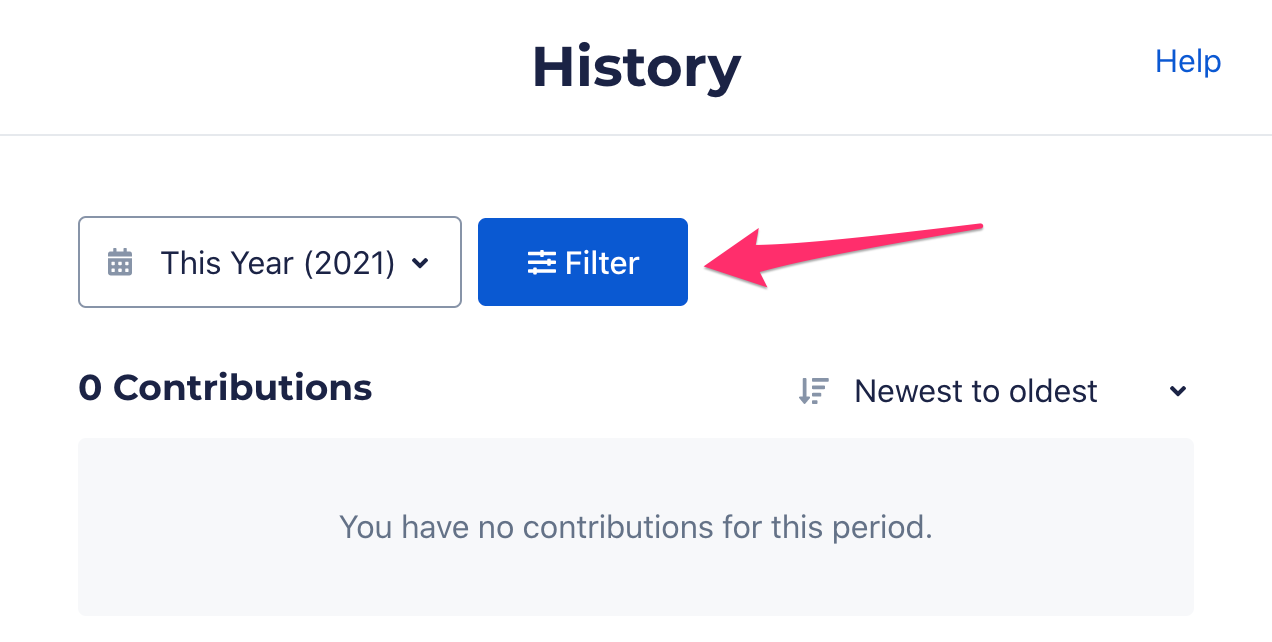

Are Political Contributions Tax Deductible Taxact Blog

Dark Money refers to political spending meant to influence the decision of a voter where the donor is not disclosed and the source of the money is unknown.

. Including real estate property taxes medical expenses and charitable contributions. Costs to facilitate a tax-free corporate distribution under IRC Section 355 such as a spin-off split-off or split-up must be capitalized and are not currently deductible. Benton will support legislation that phases out North Carolinas personal income tax to reward work and put money back in your pocket.

A political campaign donation receipt is written documentation provided to a donor for a contribution made to a political organization. While taxpayers in the bottom four quintiles would see an increase in after-tax incomes in 2021 primarily due to the temporary CTC expansion by 2030 the plan would lead to lower. Updated June 03 2022.

PayPal covers all transaction fees. The IRA is composed of 60000 in. A portion of his required program cost supports the charitable efforts of the Habitat program.

Contributions to a traditional individual retirement account IRA Roth IRA 401k and other retirement savings plans are limited by law. Exemption from federal income tax. Can I deduct this on my taxes.

Federal law requires us to obtain and report the name mailing address occupation and name of employer for each individual whose contributions aggregate in excess of 200 per election cycle. YOUR DONATION MAKES A TREMENDOUS DIFFERENCE FOR OUR CAMPAIGN. With the StartRIGHT Service it has never been easier to obtain tax-exempt status.

The top federal corporate income tax rate fell from 35 percent to 21 percent beginning in 2018. For example Susan Smith is in the 24 tax bracket this year and she only has one IRA worth 100000. Donors can contribute to a political organization by donating money or goodsservices in-kind donation.

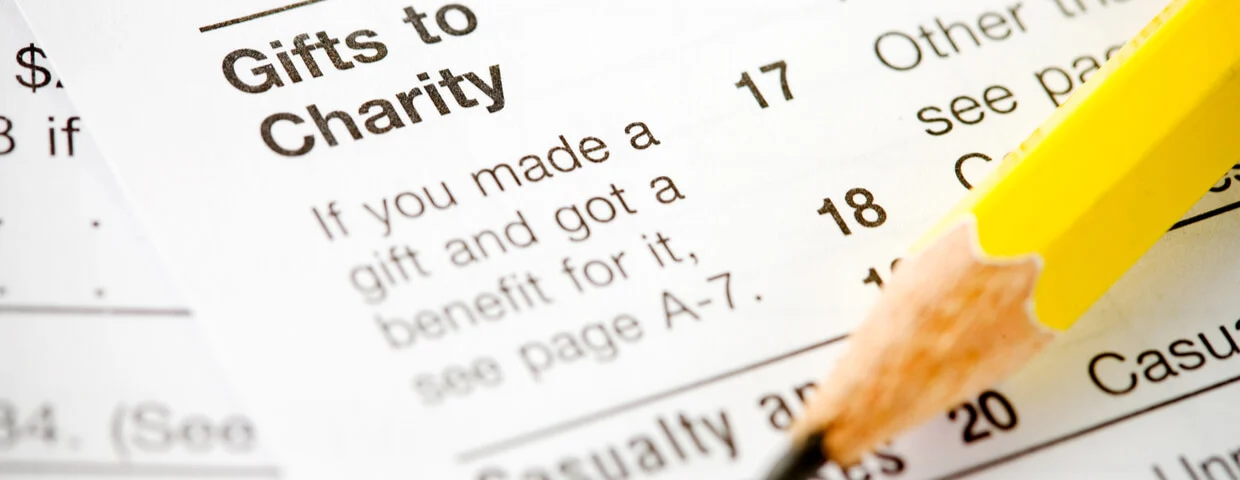

Depending on your country of origin the trip cost may or may not be tax-deductible. Tax Proposals by the Biden Administration. Although a political donation is non-deductible according to the IRS it is still wise to keep a.

Pro-Life In 2019 there were 629898 un-born children killed by abortion in the United States. I am making this contribution with my own personal. Its rare but if we cant send your money to this charity well ask you to recommend anotherIf we cant reach you well send it to a similar charity and keep you updated.

Exemption from federal unemployment tax. Bidens tax plan is estimated to raise about 333 trillion over the next decade on a conventional basis and 278 trillion after accounting for the reduction in the size of the US. Some taxpayers may execute a corporate distribution and improperly deduct the costs that facilitated the transaction in the year the distribution was completed.

Scott is a New York attorney with extensive experience in tax corporate financial and nonprofit law and public policy. Donors should consult with their own tax advisors as the tax deductibility of their donations. A 501c3 organization is a United States corporation trust unincorporated association or other type of organization exempt from federal income tax under section 501c3 of Title 26 of the United States CodeIt is one of the 29 types of 501c nonprofit organizations in the US.

Sometimes all these add up to more than the standard deduction for your filing status making it worth the time and. Contributions are not tax-deductible as charitable contributions for federal income tax purposes. Paid for by Sally Lieber for Board of Equalization 2022 FPPC 1444048 PO.

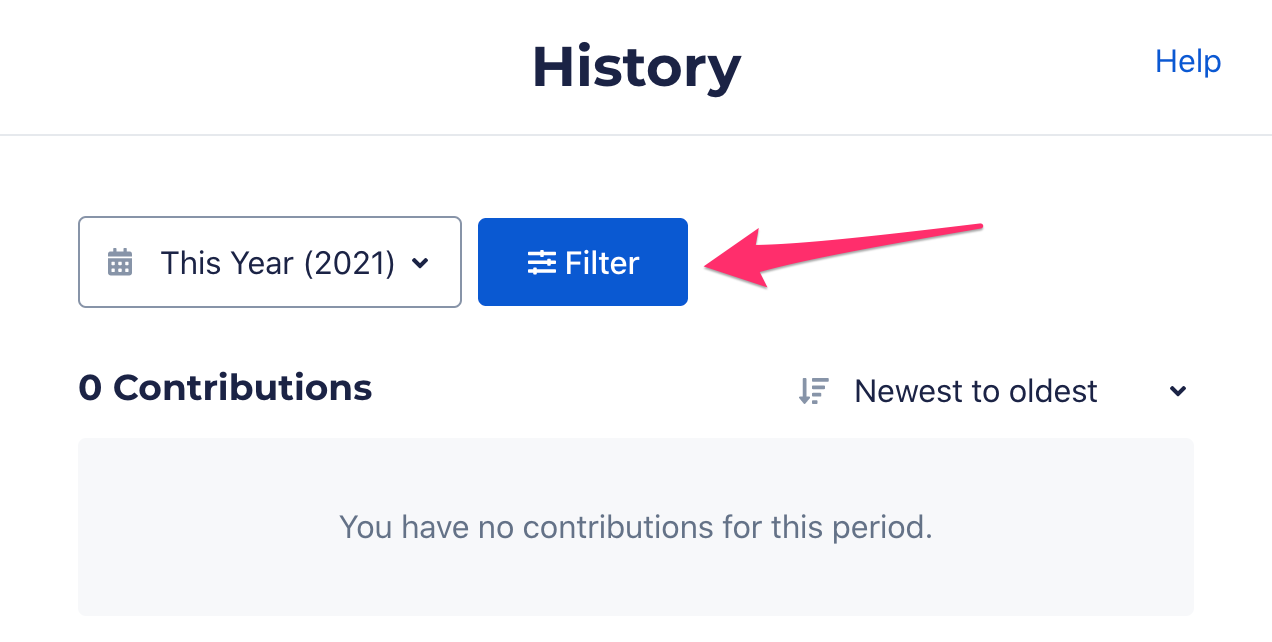

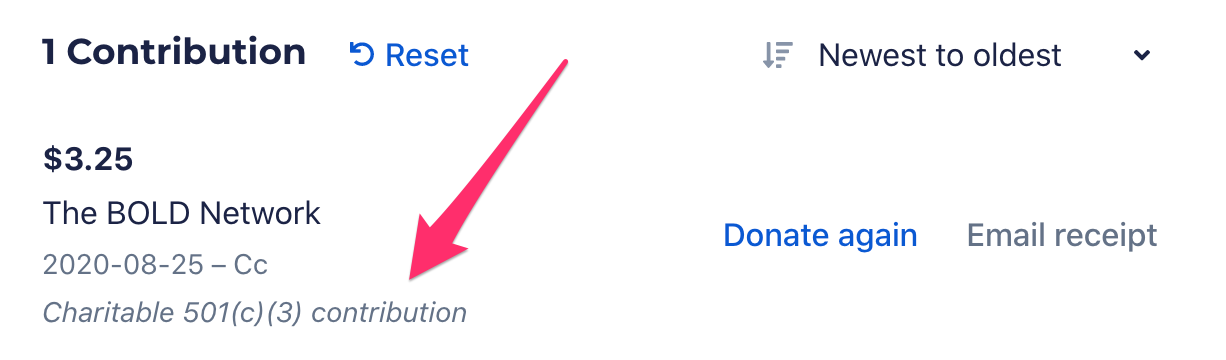

Youre donating to PayPal Giving Fund a 501c3 charity subject to its termsDonations can take up to 45 days to get to your chosen charity. 501c3 tax-exemptions apply to entities that are organized and operated exclusively for religious. Our federal tax ID is 52-1786332.

Contributions to WBCCF may be tax deductible. Box 9980 San Jose CA 95157 Contributions to this organization are not tax deductible for federal or state income tax purposes. Depending on his.

I donated 500 to my nephews trip to Honduras. Contributions are not deductible as charitable contributions for Federal income. Please consult a tax adviser concerning your specific situation.

In December 2017 Congress passed the Tax Cuts and Jobs Act TCJA which greatly changed the way corporations pass-through businesses and individual taxpayers were treated in the tax code. Campaign donations may not be used to cover the costs of benefits received by the donor from the recipient organization including for example a donors membership dues. ROBBY DOES NOT TAKE CORPORATE MONEY THAT EXPECTS SOMETHING IN RETURN FROM HIM BECAUSE HE BELIEVES POLITICIANS NEED TO ANSWER TO THE PEOPLE NOT TO CORPORATIONS.

Contributions are tax deductible. The NFF is a 501c3 charitable nonprofit organization.

Tax Deductible Donations Rules And Tips

Are My Donations Tax Deductible Actblue Support

Are Political Contributions Tax Deductible Tax Breaks Explained

The Clubhouse For Special Needs Capital Campaign To Raise 1 5 Million To Build A 10 000 Sq Ft Special Needs Commun Capital Campaign Special Needs Awareness

Are Political Contributions Tax Deductible H R Block

A New Report From The Nonprofit Nonpartisan Tax Foundation Indicates Only France S 36 Percent Corporate Tax Rate Is Hig Tax Deductions Income Tax Filing Taxes

Are Campaign Contributions Tax Deductible

Are My Donations Tax Deductible Actblue Support

Are Political Contributions Tax Deductible H R Block

Are Political Contributions Tax Deductible Turbotax Tax Tips Videos

Are My Donations Tax Deductible Actblue Support

Are Political Contributions Tax Deductible Smartasset

Are Political Contributions Tax Deductible Smartasset

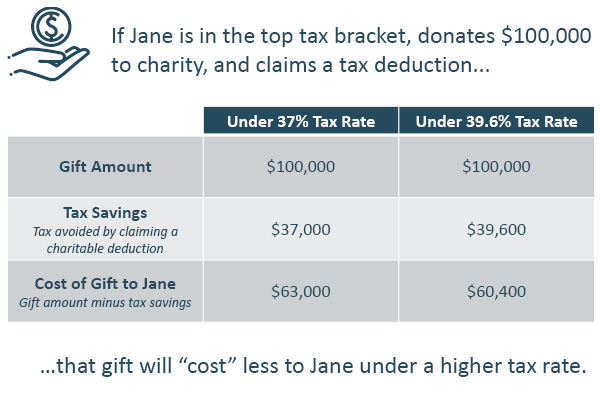

Tax Policy Changes And Charitable Giving What Fundraisers Need To Know Ccs Fundraising

Image Result For Pledge Cards For Fundraising Card Templates Free Card Template Card Templates Printable

Are Political Contributions Tax Deductible Anedot

How Much Should You Donate To Charity District Capital

Ymca Reply Donation Card Not For Profit Direct Mail Campaign Annual Appeal Fundraising Campaign Design Fundraising Letter Fundraising Campaign